How to have more than one VAT code

Hello and welcome in MyInvoice help center!

Sometimes you need to have multiple tax code (VAT) for different customer around the world. For example, you may need to apply 10% for a customer and 18 % for another one, or even 0% I.e. nothing when you sell the same product to different customer. In such situations, it could be very helpful to have a system that allow you to have more than one tax system for your business, and that is what MyInvoice cover.

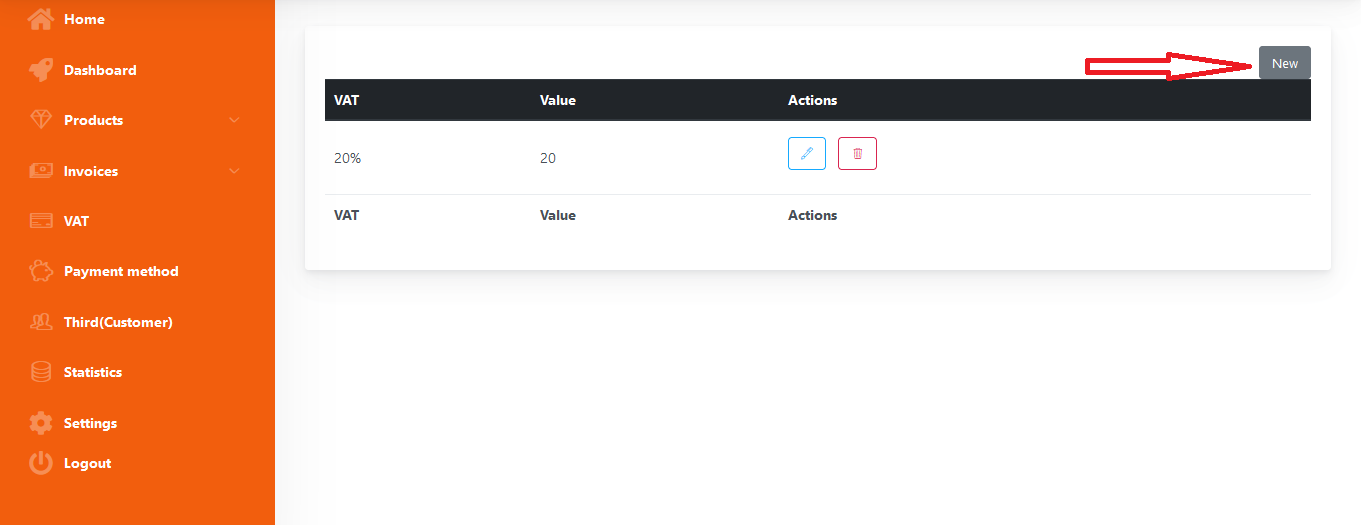

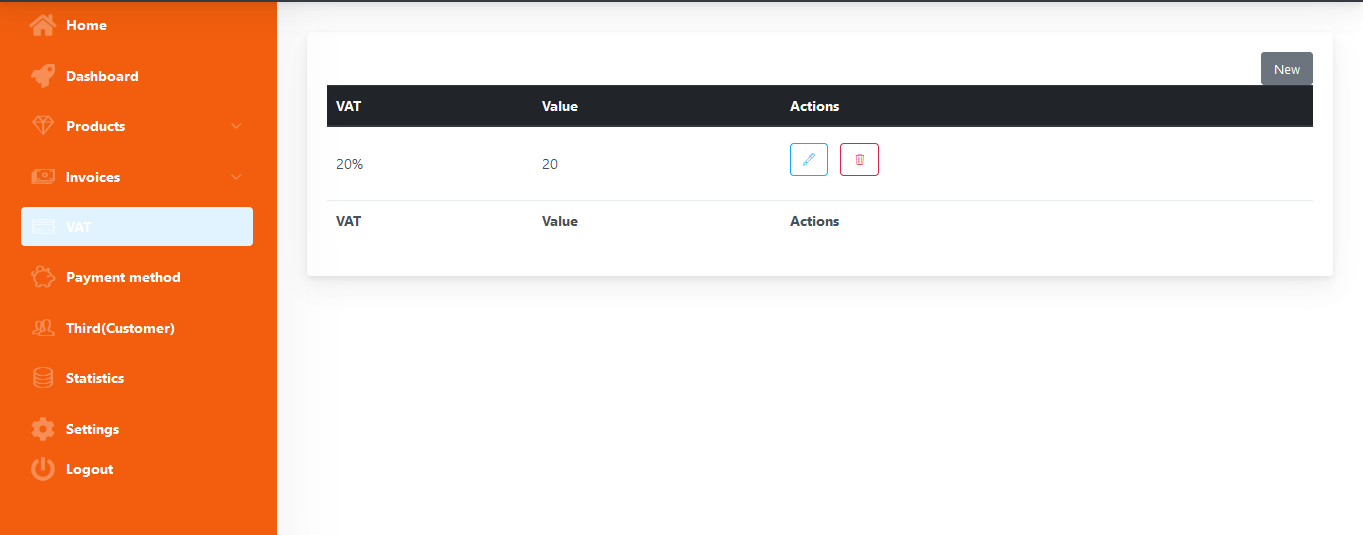

To create or see VAT codes, just click on “VAT” from the left side menu as shown in the following picture

A page with all your registered VAT or tax code will appear, you will notice that there is a 20% default tax code. You can edit or delete this value if you don’t need to apply tax on your sales, and create new ones if you need more than one tax value

Click on the “new” button as shown in the following picture and then fill the form that will appear